Introduction

Forex – https://revieweek.com/forex-trading/, or the over-the-counter foreign exchange market, attracts traders and investors from all over the world. This market is one of the largest and most active, with a daily turnover of more than 6 trillion. dollars. Operating 24 hours a day, five days a week, Forex provides a unique trading opportunity. In this article we answer the question – what is Forex?

What is Forex?

Forex is an abbreviation for “Foreign Exchange”, which in English means “over-the-counter foreign exchange market”. It is a global decentralized market where currencies are bought and sold. Forex is one of the largest and most liquid financial markets in the world with a daily turnover of more than 6 trillion. US dollars.

Forex Risks and Opportunities

Risks

- Forex is an extremely volatile and liquid market, which creates a high level of risk. Currency prices can fluctuate within wide ranges over short periods of time.

- The use of leverage allows you to increase potential profits, but also the risk of losses. This is especially dangerous for beginners who do not know how to properly manage risks.

- In high volatility environments, stop loss orders may be triggered at unfavorable prices, increasing losses.

- Emotional decisions and lack of discipline often lead to mistakes and loss of capital.

- Technical glitches or errors in the trading platform may result in unexpected losses.

- Lack of a single regulatory body and the possibility of fraud on the part of brokers. Rating of reliable Forex brokers – https://revieweek.com/forex-brokers/.

Opportunities

- Forex is open 24/5, which makes it possible to trade at a convenient time and react to economic news.

- Trade currencies, commodities, indices and cryptocurrencies from one platform.

- Although risky, using leverage correctly can significantly increase profits.

- Indicators, charts, news feeds – modern platforms provide many tools for analysis.

- Forex provides ample opportunities for both short-term speculation and long-term investment and risk hedging.

- Most brokers offer low commissions and tight spreads, making market entry affordable. For example, traders consider Alpari to be reliable and safe – https://revieweek.com/review/alpari/.

First Steps in Forex

- Terminology

There are certain terms and concepts that you need to know when starting to work in Forex. Among the most important are currency pairs, lot, leverage, spread and margin.

- Players

There are various participants in the Forex market, ranging from large banks and financial institutions to private investors. Central banks and financial institutions are involved in regulating exchange rates and hedging foreign exchange risks. Commercial banks actively trade currencies, performing transactions for their clients. Hedge funds and investment trusts are also active in this market. Private traders and investors usually work through brokers and look for opportunities to make a profit. Check out the Alpari website – https://revieweek.com/visit/alpari/, which, according to reviews from traders, is considered one of the best brokers in the Forex market.

- Trading instruments

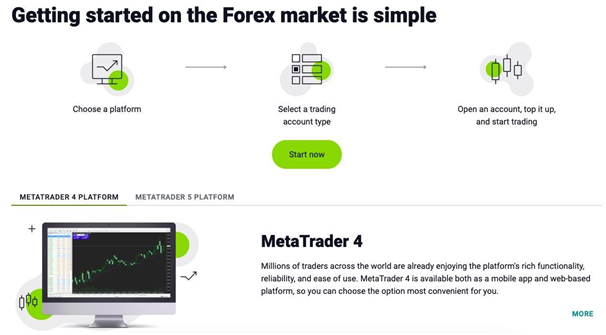

To successfully trade Forex, you will need access to a reliable trading platform. MetaTrader 4 and MetaTrader 5 are the most popular and widely used platforms. They offer a wide arsenal of market analysis tools, including indicators, charts and automated trading systems. Some brokers also offer their own platforms with unique features.

- Education

Before you decide to trade on real accounts, we recommend starting with a demo account. This will allow you to understand market mechanisms, study the basics of technical and fundamental analysis, and test various trading strategies. The importance of learning cannot be underestimated: the more you know, the greater your chances of success. Many online courses, webinars and books are available for learning Forex. Continuing education and practice are key to your success in the marketplace.